child tax credit dates

The amount of credit you receive is based on your income and the. A payment of tax credits for the tax year 2022 to 2023.

Maximizing The Child Tax Credit Infographic Csh

In 2022 the tax credit could be refundable up to 1500 a rise from 1400.

. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. 22 rows 28 December - England and Scotland only. To reconcile advance payments on.

According to a recent audit from The Treasury Inspector General for Tax Administration the Internal Revenue Service IRS failed to distribute advance child tax credits. The province doesnt matter. You will be eligible for the second Cost of.

Wait 5 working days from the payment date to contact. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit.

All payment dates. The CRA makes Canada child benefit CCB payments on the following dates. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Families who sign up by the Nov. The Child Tax Credit Update Portal is no longer available. What recipients spent money on part one.

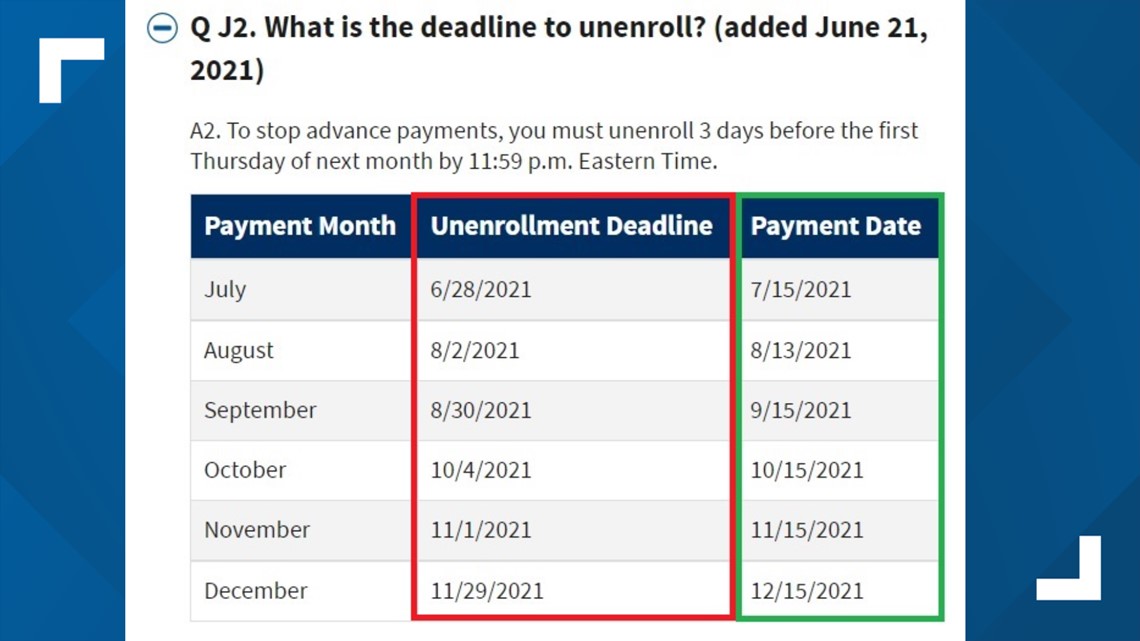

An annual award of at least 26 of tax credits for the tax year 2022 to 2023. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The child tax benefit pay dates are the same all across Canada whether you are in BC Alberta or whether you are in Ontario.

The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36 million families it believed to be eligible to receive them. The amount you can get depends on how many children youve got and whether youre. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The New Democrat Coalition which numbers 99 lawmakers wants to revive the expanded child-tax credit which was raised from 2000 per child to as much as 3600 in. Nearly 665billion of this years federal budget provides aid to low-income individuals and families. Canada child benefit payment dates.

Making a new claim for Child Tax Credit. According to the Center for Budget and Policy Priorities 91 percent of families making less than 35000 per year are using their. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax.

Families could be eligible to. If the total amount of your advance Child Tax Credit payments was greater than the Child Tax Credit amount that you may properly claim on your 2021 tax return you may. The payments will be made either by direct deposit or by paper check depending on what.

Prior to 2021 the maximum value of the Child Tax Credit was 2000 per eligible child. 13 opt out by Aug. Havent received your payment.

Federal fund programming. 15 opt out by Aug. Last year the boosted Child Tax Credit maxed out at 3600 for children under the age of.

This means a payment of up to 1800 for. The refundable portions of the Earned Income Tax. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

Have been a US. Already claiming Child Tax Credit. Child Tax Benefit Phone.

Here are the official dates. 3 January - England and Northern Ireland only. 15 deadline according to the IRS will normally receive half of their total child tax credit on Dec.

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

The Deadline To Unenroll Or Opt Out Of The Child Tax Credit Wfmynews2 Com

About The 2021 Expanded Child Tax Credit Payment Program

Some Families Missing Out On Child Tax Credit

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Child Tax Credit Dates Here S The Entire 2021 Schedule Money

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

How The New Expanded Federal Child Tax Credit Will Work

Deadline To Claim Child Tax Credit Fast Approaching Ct News Junkie

When Will You Get The Child Tax Credit Monthly Payments Your Questions Answered Forbes Advisor

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Child Tax Credit Payment Schedule Here S When To Expect Checks Wltx Com

Child Tax Credit Checks These Are The Dates The Irs Plans To Send Payments Wfla

Abc7 Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those Families

Child Tax Credit Schedule 8812 H R Block

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Child Tax Credits Causing Confusion As Filing Season Begins

Child Tax Credit Payments May Be Smaller For Some Going Forward 10tv Com